Every few days, we get an inquiry from a curious user about whether Stax is the latest in the long line of digital banks or e-wallets that have taken over the African technology landscape.

In this article, we’ll be answering the question of what Stax is, and how to classify it as a ‘Fin’TECH product.

Summary:

- Stax is a user agent — a utility tool — that helps people make transactions from their existing financial service provider(s)

- Stax is not a digital bank or an e-wallet.

- Stax does not store sensitive account details like your transaction pin, ID etc.

- Stax requires your SIM card to be present to act as an agent on your behalf.

What is the difference between a digital bank, wallet and a user agent?

There are different categories in consumer fintech, of which digital banks and e-wallets are some of the most popular. User agents, not so much. So to explain how Stax is different, you must understand the three categories.

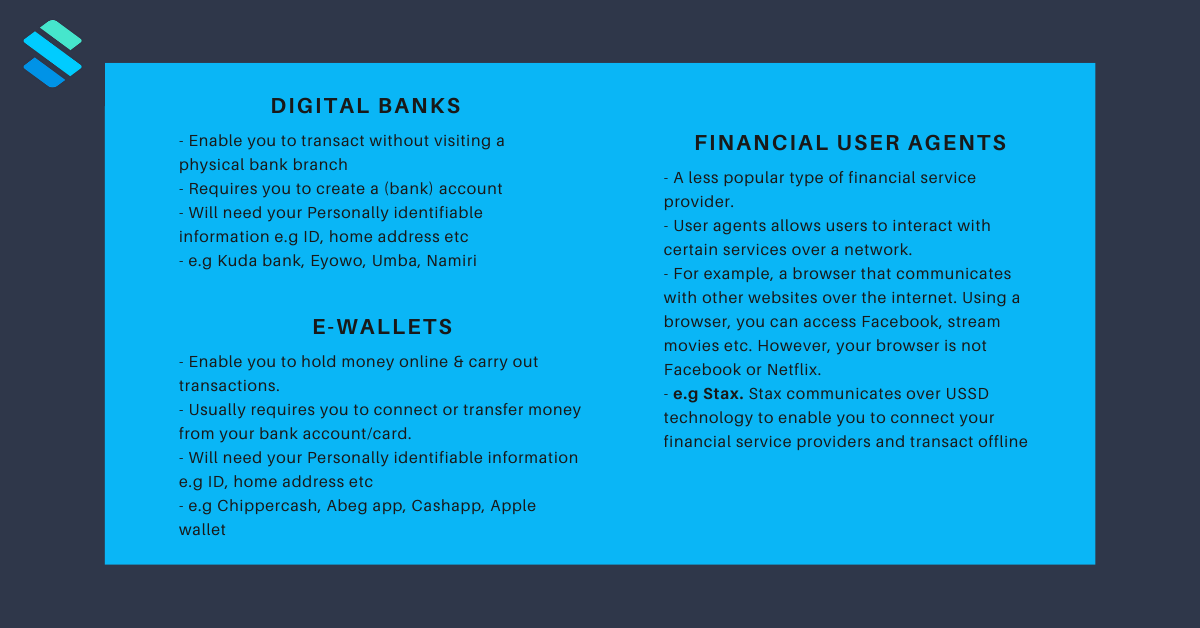

Digital banks are products that help users carry out banking activities online without ever visiting a physical bank branch. With a digital bank, you can do most of the things a traditional bank can do, including sending money, paying bills, receiving money, buying airtime, taking loans, owning a debit/credit card, overdrafts etc. However, to use a digital bank, you have to create an account — of which you will need some kind of identification like your ID, home address, etc. Common examples of digital banks are Kuda bank, Eyowo, Umba, Namiri, etc.

E-wallets, on the other hand, allow users to hold money online and carry out transactions from a mobile app. However, e-wallets usually need you to connect or transfer money from your bank account or card to function properly. You might also be required to provide personally identifiable information (PII), e.g. ID, home address, etc., to the wallet provider to access the service. Most e-wallets allow people to perform similar transactions to digital banks, i.e. transfers, topping up your phone, paying bills, etc. Examples of e-wallets are ChipperCash, Abeg app, Skrill etc.

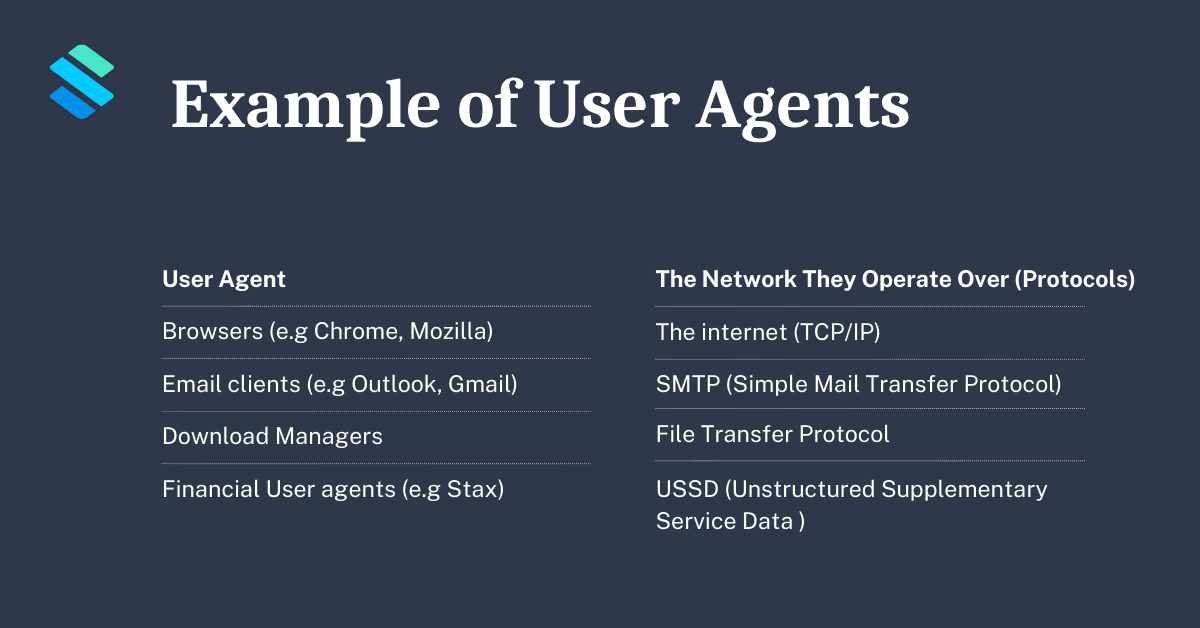

On the other hand, user agents or utilities are a less common type of financial service provider. In fact, the expression “user-agent” is a more technical than financial term. Simply put, it means a computer program that allows you to interact with certain services over a network.

A typical example of a user agent is your computer browser. Using a browser, you can access Facebook, send emails, stream movies, and do a lot more. However, your browser is neither a Facebook app, an email app, or Netflix. Instead, your browser is a user agent that communicates with other websites over the internet to facilitate the transfer of data to your device.

Another example is email clients like Outlook and Gmail. They fall under the category of a Mail User Agent — a program that allows you to send and receive email messages. These Mail User Agents are what you interact with instead of an email server, which actually transports the email messages.

An even simpler way to understand Stax as a user agent is to compare it to your local POS/Mobile money agent. When you need to make a transaction from your account, you go to the vendor and supply your account details to help you conduct the transaction. Stax is like that agent, but this time, right in your palms. You don’t need to go anywhere.

User agents typically operate over a specific kind of network, for browsers — the internet (TCP/IP), email clients — SMTP (Simple Mail Transfer Protocol), mobile money agents, a POS machine, or an agent app. While for Stax, it is USSD.

In addition, Stax requires the SIM connected to your bank/MoMo account to be present in the phone to act as a user agent and dial USSD codes for you.

What Makes Stax a User Agent?

To understand how Stax works, we will need to take a look at what the app does and what it does not do.

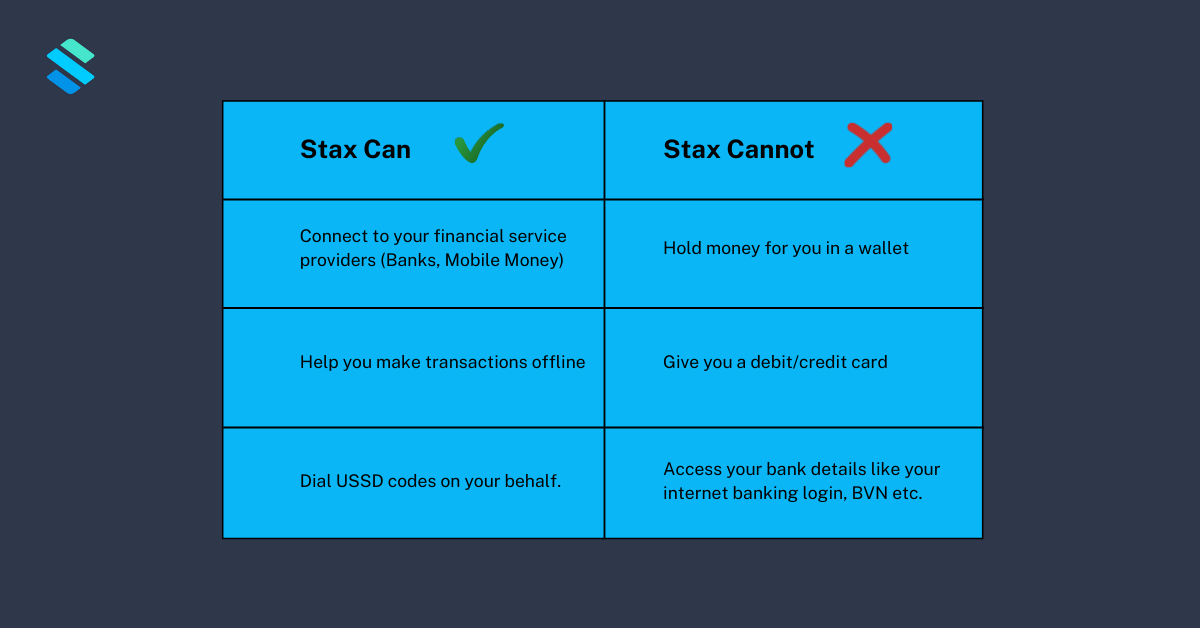

Stax can:

- Connect to your financial service providers (Banks, Mobile Money companies).

- Help you make transactions offline (buy airtime, send and request money).

- Dial USSD codes on your behalf.

Stax Cannot:

- Hold money for you in a wallet. When you move money between your accounts using Stax, the money never touches a Stax account; it goes directly to and from your bank/MoMo accounts.

- Give you a debit/credit card.

- Access your bank details like your internet banking login, BVN etc.

You may be thinking, “so how exactly does Stax make transactions happen?”. Well, that’s where the user agent part comes in. Stax is built on USSD technology that many financial service providers already provide for their users to make transactions.

Fun fact: According to GSMA, 9 in10 banking transactions still go through USSD.

Simply put, Stax helps you type USSD codes so that you never have to store them in your head. Doing that process means that you never have to remember the USSD shortcodes or follow through with multiple steps like “Press 1 to enter account details”, “Press 7 to select destination bank”, and more.

With Stax, it’s the same transaction process, with less stress. Something important to also remember is that for every transaction, the user’s SIM card must be present, meaning that Stax uses a 2-factor system (SIM +USSD PIN).

So, what information does Stax collect from me to power transactions?

At Stax, data privacy is a priority.

In fact, “data rights = human rights. When it comes to personal data, less is more. Collect it rarely; protect it always” is one of our core company values.

This means that we try to collect the least amount of data possible from you. To link an account to Stax, we only need to detect your SIM and match it to the bank/MoMo accounts connected to it.

When completing transactions, Stax helps you dial the correct codes for the transaction and proceeds to the final step of the transaction — where you input your USSD PIN, which the app, using Andriod Key Store, encrypts and deletes immediately after every transaction.

Here’s How You Can Think About Stax

You can think about Stax:

- As your browser for transacting with multiple financial accounts. No stress, just convenience like never before — so much so that you can even uninstall your other bank/MoMo apps and use Stax to transact with all of them 😁.

- As your personal agent. No need to go to a vendor and pay extra to transact. Stax does not charge users for making transactions via its application. The only charges you get are those that your financial service provider already has on the transaction (e.g USSD fees). Also, you get to do your transaction from the comfort of your phone. No stress involved!

Want to learn how to use Stax. Watch demo videos here

Please share this article